-

U.S. Global Investors Announces Results for Fiscal Year 2022, with Operating Income Up 36% Year-over-Year and Operating Margin of 45%

ソース: Nasdaq GlobeNewswire / 01 9 2022 18:16:41 America/Chicago

SAN ANTONIO, Sept. 01, 2022 (GLOBE NEWSWIRE) -- U.S. Global Investors, Inc. (NASDAQ: GROW) (the “Company”), a registered investment advisory firm with longstanding experience in global markets and specialized sectors from gold to airlines, is pleased to report financial results for the fiscal year ended June 30, 2022.

For the 12-month period, total operating revenues were $24.7 million, a 14% increase year-over-year (YOY). Operating income was $11.1 million, a 36% increase YOY. Operating margin was 45%, up from 38% in fiscal 2021.

As of June 30, 2022, the Company had net working capital of approximately $33.9 million, a 57% increase from June 30, 2021. With approximately $22.3 million in cash and cash equivalents and $13.8 million in securities recorded at fair value, excluding convertible securities, the Company has adequate liquidity to meet its current obligations.

“This year, we have been building up our cash position, which we believe is wise and prudent to weather a potential economic recession and be opportunistic in looking for attractive acquisitions,” CEO and Chief Investment Officer Frank Holmes says.

Net income was $5.5 million, or $0.37 per share, down from $32.0 million a year earlier, or $2.12 per share. A significant contributor to the decrease in annual net income was mark-to-market volatility. The Company had lower realized gains and unrealized losses on investments in the current year compared to higher realized and unrealized gains on investments in fiscal 2021. Mark-to-market is an accounting practice that involves adjusting the value of an asset to reflect its value as determined by current market conditions. The market value is determined based on what a company would get for the asset if it was sold at that point in time. Therefore, mark-to-market losses are paper losses generated through an accounting entry rather than the actual sale of a security.

During fiscal 2022, average assets under management (AUM) were $3.9 billion, an 18% increase from $3.4 billion during the 12-month period ended June 30, 2021. However, total AUM as of June 30, 2022, was $2.9 billion, down from $4.2 billion as of June 30, 2021, due to a global stock market decline and higher interest rates.

Retail Trading Has Contracted from Pandemic Highs

At the beginning of the pandemic in the spring of 2020, retail trading activity surged as a new audience of investors and speculators, stuck at home and having received a fresh infusion of government stimulus money, began participating in the market. This enthusiasm for distressed stocks and industries benefited the U.S. Global Jets ETF (JETS), and by March 2021, the smart-beta airlines ETF surpassed $4 billion in AUM.

Much of the early trading was ignited on Robinhood, a commission-free broker that primarily targets younger investors, which has recently seen a sizeable decline in the number of active users as markets fell due to rising inflation and interest rates, higher oil prices and an ongoing war in Ukraine. In June 2022, Robinhood reported having 14 million monthly active users, down more than a third from the second quarter of 2021, when it reported having 21.3 million.

This, the Company believes, coupled with other systemic market risks outlined above, has greatly contributed to lower trading volumes and AUM.

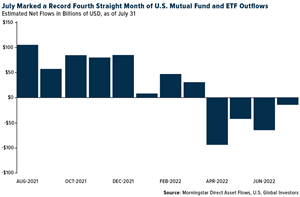

“Investor sentiment is unusually low right now due to a variety of factors, with U.S.-based mutual funds and ETFs seeing a record four straight months of net outflows as of July 2022, according to Morningstar data. However, on a relative basis, the U.S. Global Jets ETF (JETS) did much better than tech ETFs,” Mr. Holmes says. “The good news is that outflows in July were not as great as those in the previous three months, leading us to believe that sentiment could be ready to shift to the upside.”

SEA ETF: The Latest Product Launch

On January 19, 2022, the Company launched its third ETF, the U.S. Global Sea to Sky Cargo ETF (SEA). The smart-beta ETF, which invests in marine shipping, air freight and courier, and port and harbor companies, beat the S&P 500 Index and Nasdaq-100 Index from inception to August 12, 2022.

“Container shipping companies have incredible pricing power, so we believe they could be an attractive hedge against inflation for investors,” Mr. Holmes says. “Global shipping routes and seaports continue to see significant snarls and supply chain issues, which hurts consumers but could be a windfall for shareholders. Thanks to elevated shipping rates, carriers are forecasted to turn in its most profitable year ever in 2022. Total net income for the industry could be as high as $256 billion, according to estimates by Blue Alpha Capital, which would be an impressive 73% above the industry’s profits last year.”

A Challenging Year for Digital Assets

Due to the widespread selloff in digital currencies and assets, including Bitcoin and Ethereum, there has been significant volatility in the market price of HIVE, which has materially impacted the fair value of the Company’s investment.

“It was an extremely challenging year and quarter for the global digital asset ecosystem, where we saw the capitulation of Bitcoin and Ethereum prices to levels not seen since 2020,” says Mr. Holmes. “However, during this period, HIVE Blockchain Technologies Ltd. (“HIVE”) generated record revenues and earnings. Our investment in HIVE includes 8% interest-bearing convertible notes, payable in quarterly installments with a final maturity in January 2026, and warrants to purchase 1 million common shares. The notes have been paid down from $15 million to $10.6 million, and the warrants have impacted our non-realized mark-to-market volatility. I urge investors to visit HIVE’s website by clicking here.”

Enhanced Share Repurchase Program

The Company announced in February 2022 that the Board of Directors (the “Board”) approved an increase to the limit of its annual share buyback program from $2.75 million to $5.0 million. During fiscal year 2022, the Company bought back 89,287 class A shares using cash of $452,000. This represents an approximately 68% increase from the number of shares that were repurchased in fiscal 2021, and a 44% increase in the amount of cash used.

As of June 30, 2022, approximately $4.7 million remains available for repurchase under this authorization. The Company uses an algorithm to buy back stock on down days.

Growth in GROW Dividends

As of June 30, 2022, the Board has authorized a monthly dividend of $0.0075 per share through September 2022, at which time it will be considered for continuation. Payment of cash dividends is within the discretion of the Board and is dependent on earnings, operations, capital requirements, general financial condition of the Company and general business conditions. Dividends totaling $1.1 million were paid to holders of class A common stock in fiscal year 2022, an increase of over 90% compared to the previous 12-month period.

Earnings Webcast Information

The Company has scheduled a webcast for 7:30 a.m. Central time on Friday, September 2, to discuss the Company’s financial results for the year. Frank Holmes will be accompanied on the webcast by Lisa Callicotte, chief financial officer, and Holly Schoenfeldt, director of marketing and public relations. Click here to register for the earnings webcast or visit www.usfunds.com for more information.

Selected Financial Data-: (dollars in thousands, except per share data)

Year ended June 30, 2022 2021 Operating Revenues $24,714 $21,654 Operating Expenses 13,601 13,489 Operating Income 11,113 8,165 Total Other Income (Loss) (4,017 ) 29,273 Income Before Income Taxes 7,096 37,438 Income Tax Expense 1,597 5,477 Net Income $5,499 $31,961 Net income per share (basic and diluted) $0.37 $2.12 Weighted avg. common shares outstanding (basic) 15,010,138 15,067,044 Weighted avg. common shares outstanding (diluted) 15,011,128 15,067,953 Avg. assets under management (billions) $3.9 $3.4 About U.S. Global Investors, Inc.

The story of U.S. Global Investors goes back more than 50 years when it began as an investment club. Today, U.S. Global Investors, Inc. (www.usfunds.com) is a registered investment adviser that focuses on niche markets around the world. Headquartered in San Antonio, Texas, the Company provides money management and other services to U.S. Global Investors Funds and U.S. Global ETFs.

Forward-Looking Statements and Disclosure

This news release and other statements by U.S. Global Investors may include certain “forward-looking statements,” including statements relating to revenues, expenses and expectations regarding market conditions. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “opportunity,” “seeks,” “anticipates” or other comparable words. Such statements involve certain risks and uncertainties and should be read with corporate filings and other important information on the Company’s website, www.usfunds.com, or the Securities and Exchange Commission’s website at www.sec.gov.

These filings, such as the Company’s annual report and Form 10-Q, should be read in conjunction with the other cautionary statements that are included in this release. Future events could differ materially from those anticipated in such statements and there can be no assurance that such statements will prove accurate and actual results may vary. The Company undertakes no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com. Read it carefully before investing. U.S. Global mutual funds are distributed by Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Past performance does not guarantee future results.

Total Annualized Returns as of 06/30/2022:

Fund One-Year Five-Year Ten-Year Since Inception Expense Ratio U.S. Global Sea to Sky Cargo ETF (SEA) NAV n/a n/a n/a -1.30%

01/19/2022Gross: 1.90%

Net: 0.60%U.S. Global Sea to Sky Cargo ETF (SEA) Market Price n/a n/a n/a -0.90%

1/16/2022Gross: 1.90%

Net: 0.60%U.S. Global Sea to Sky Cargo Index n/a n/a n/a -10.46%

1/16/2022n/a S&P 500 Index -10.62% 11.31% 12.93% 9.54%

12/30/1927n/a NASDAQ 100 -20.43% 16.33% 17.24% 13.75%

2/1/1985n/a The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Short term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. For SEA performance data current to the most recent month-end, please visit www.usglobaletfs.com, or call 617.786.3000.

Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser. JETS and SEA are distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS and SEA. Foreside Fund Services, LLC and Quasar Distributors, LLC are affiliated.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds. The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies. The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index. Airline Companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. By investing in a specific geographic region, such as China and/or Taiwan, a regional ETFs returns and share price may be more volatile than those of a less concentrated portfolio.

The COVID-19 pandemic and the resulting actions to control or slow the spread has had a significant detrimental effect on the global and domestic economies, financial markets and industries, including airlines. U.S. Global Investors continues to monitor the impact of COVID-19. Cargo Companies may be adversely affected by downturn in economic conditions that can result in decreased demand for sea shipping and freight.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

A smart-beta ETF is a type of exchange-traded fund that uses a rules-based system for selecting investments to be included in the fund.

The S&P 500 is widely regarded as the best single gauge of large-cap U.S. equities and serves as the foundation for a wide range of investment products. The index includes 500 leading companies and captures approximately 80% coverage of available market capitalization. The NASDAQ-100 Index is a modified capitalization-weighted index of the 100 largest and most active non-financial domestic and international issues listed on the NASDAQ.

Mr. Holmes is the executive chairman of HIVE. Effective August 31, 2018, Mr. Holmes was named Interim CEO of HIVE. Cryptocurrency markets and related stocks have been, and are expected to continue to be, volatile, and may be influenced by a wide variety of factors, including speculative activity.

It is not possible to invest in an index.

Contact:

Holly Schoenfeldt

Director of Marketing and Public Relations

210.308.1268

hschoenfeldt@usfunds.comPhotos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/3a92ecd4-c642-43ab-9c87-4b839ad99bab

https://www.globenewswire.com/NewsRoom/AttachmentNg/5b63fbb2-a837-40c0-a51f-ea5756187fd7